Are you ready for a history lesson?

Well, the short answer to “why does the tax year end on 5 April?” is that three things conspired to act together:

• In the old days, agriculture was the dominant business in Great Britain and “the year” revolved around sowing, tending, harvesting and preserving.

• So, traditionally (and until 1752) the tax year in Great Britain started on 26 March (the old “New Year’s Day”) and ended on 25 March.

• Then along came Pope Gregory XIII who for pragmatic reasons, wanted to score a point off Julius Caesar.

Perfectly clear, no? Pope Gregory did stuff in 1582 and it took Great Britain until 1752 to catch on. Let’s have a look at the long answer!

In the really old, old days, few people travelled far from home and calendars and clocks were not particularly important, the natural rhythm of life was tied to the natural rhythm of the seasons, and the variable amounts of daylight. Unless of course you were a Roman soldier! Building massive empires needs some coordination after all!

The Roman Civic calendar had been in place for as long as anybody could care to remember, and it’s origins were pretty obscure anyway. It was also inaccurate. By about 48 BC Caesar and his wise nobles were becoming increasingly troubled by the fact that the solar year and the Roman Civic calendar were becoming increasingly out of step. According to the astronomer Sosigenes it was three months out of step to be precise! They worked out that the solar year was 365 ¼ days long and they created the new Julian calendar, introducing the leap day for the first time. It wasn’t on 29 February though. It was decreed that every four years there will be two consecutive days called 23 February. Naturally!

Problem solved!

But it wasn’t!

To get things back into line, Caesar arranged for the year 46 BC to have 445 days! And because calendars and clocks were not particularly important to anybody but the military, it wasn’t until the year 8 BC that the new Julian calendar was widely adopted across the Roman Empire. The problem though, was that Sosigenes had overestimated the length of the solar year by 11 minutes and 14 seconds.

Then along came Pope Gregory and his nobles in the 1500s, and they spotted that this wonderful new Julian calendar was out of step with the solar year by about 10 days! A perfect excuse to put things right and to get your name in the headlines for ever more. The Gregorian calendar was established in 1582 when 4 October was immediately followed by 15 October.

Except that some parts of Europe (and beyond) were not prepared to take orders from a Catholic Pope, and so the Protestant and Orthodox countries (and others) did not follow suit. Even to this day, the dates of Easter vary between countries, according to their religious preference for the Julian calendar, the modified Julian calendar, or the Gregorian calendar! What a harmonious planet we live on!

In 1582 Austria, Spain, Portugal, Italy, Poland, and the Catholic states in Germany ended up out of step with the rest of Europe by 10 days. Gradually other countries came into line (because the astronomers were right, not because the Pope was right) and Great Britain made the switch a mere 170 years late, in 1752.

Turkey became the last European country to officially switch to the new Gregorian calendar, on 1 January 1927. Just 345 years after Italy did it.

Now go to present day Ethiopia and see how they have a 13 month calendar and a 12 hour day! One hour of Ethiopian time is not the same as one hour of Western time. One hour of Ethiopian time today is not even the same as one hour of Ethiopian time yesterday. The day starts at dawn and ends at dusk, and regardless of its length the day is split into 12 equal hours. They call new year’s day Enkutatash and it happens on either 11 or 12 September (on the Gregorian calendar).

But enough of this banter! You haven’t answered the question! Why does the tax year end on 5 April?

Well you were warned, it’s a long answer!

In Britain The Calendar (New Style) Act 1750 brought things into line with most of Europe, and that meant that 1752 was going to be a short year. Wednesday 2 September 1752 was followed immediately by Thursday 14 September 1752.

The problem was the uproar at The Exchequer, because they wanted a full year’s worth of tax to play with. And that’s when the end of the tax year moved from 25 March to 4 April. The Exchequer had a full 365 days’ worth of tax.

And that kept them happy until 1800.

Even though 1800 should have been a leap year, the Gregorian calendar decreed that 1800 was not a leap year owing to Sosigenes and his 11 minutes and 14 seconds miscalculation. Clawing back one day from 1800 compensated for centuries of getting pesky Julian calendar interference stuck in the magnificent Gregorian calendar precision.

But oh no! British civil servants being British civil servants were not standing for that! Losing one day of tax revenue! Hence, the end of the tax year was moved again, from 4 April to 5 April.

And there you have it, that is why the tax year ends on 5 April.

Practically every other country in the world has adopted the calendar year as their tax year. Even Ireland did that, in spite of the legacy 5 April date which the newly formed Republic of Ireland had inherited from the British system.

Why won’t Britain adopt a calendar year based tax year? You guessed it! British civil servants being British civil servants won’t stand for that!

How does the tax year affect you?

Limited companies

For limited companies, the financial year runs from 1st April one year to 31st March the following year. This is the date that the government typically sets new tax rates and rules to start on – for example, a new corporation tax rate may begin on 1st April in any given year.

The accounting year end is the date that a limited company chooses to prepare its accounts to every year. It runs from the day after the previous accounting year end to the next accounting year end. Many limited companies, but not all, choose 31st March for their accounting year end so that their accounting year matches the financial year.

The date you choose to begin your accounting year will affect when you pay tax on your profits, as companies pay tax nine months and a day after their accounting year end. For example, if you prepare your company’s accounts to 31st December each year, Corporation Tax will be due by 1st October.

Sole traders & partnerships

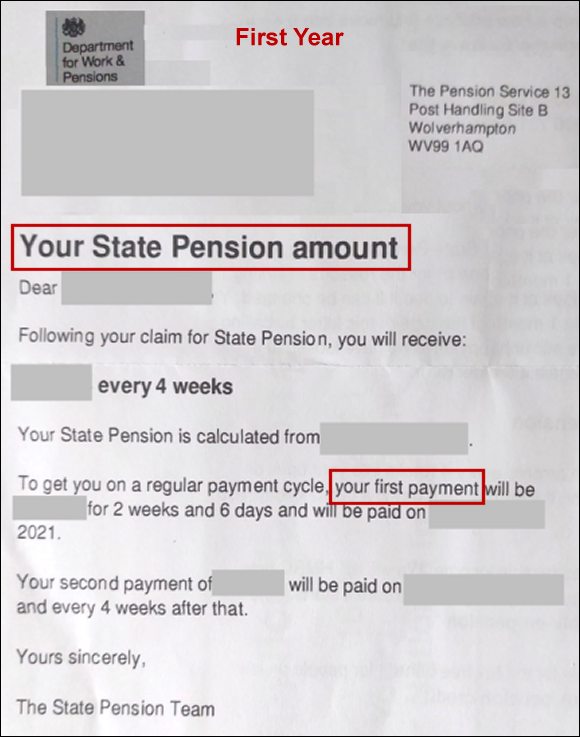

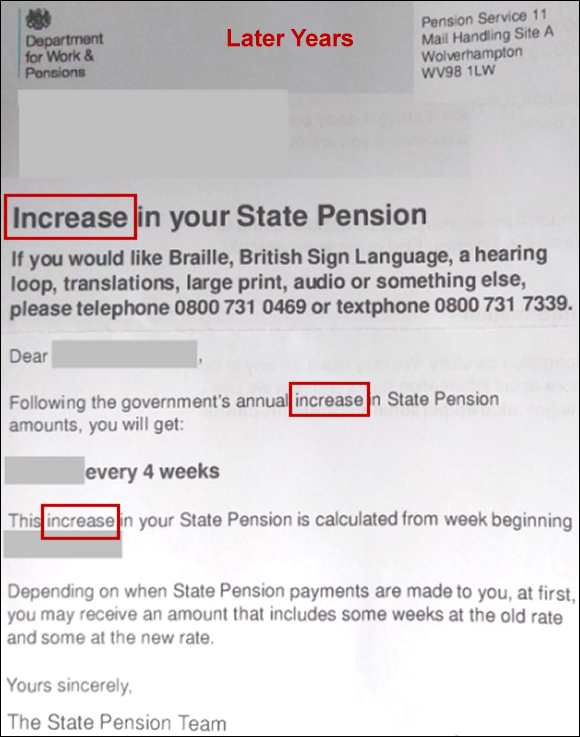

For sole traders, partnerships and individuals working for a company, the tax year, also known as the fiscal year, runs from 6 April one year to 5 April the following year.

Many sole traders, but not all, choose 5 April for their accounting year end so that their accounting year will match the tax year. By concession from HMRC, a sole trader who chooses 31 March for their accounting year end is also treated as having an accounting year that matches the tax year.