Every time a bookkeeping exercise is done we generate a number of reports. Amongst other things, the reports will tell you how much profit you are making, how much your tax reserve should be, and how much your customers still owe you. Dates are shown in scientific notation YYYYMMDD so that when you view a folder, files are listed first by document type and then by date.

The reports usually relate to one quarter in isolation, and this is what we normally prepare:

– 300330 VAT return

– 300335 VAT acknowledgement

– 488120 ledgers’ report

– 488160 interim balance sheet

– 488220 aged debtors

– 488240 interim profit and loss account

If you’re not VAT registered then ignore the fact that there are no 300330 and 300335 reports.

The 300330 report – A software version of the HMRC VAT return

The figures on this report are prepared in accordance with MTD for VAT and are submitted from our software directly to the HMRC mainframe. This copy of the VAT return is now the only version which is available under MTD for VAT.

The 300335 report – A software version of the HMRC submission receipt

This is the only proof you have that the VAT return was submitted.

The 488120 report – a full list of which transactions go into which ledgers

The general ledger is prepared the way that accountants and bookkeepers like to do it. The ledgers’ report lists every single transaction . . . twice. If you like double entry bookkeeping then this is the report that will show you how everything is recorded.

What you should be especially interested in are the sections of this reports that list the Debtors and the Creditors. These sections set out (on a case by case basis) who owes your business money, and who is owed money by your business.

Most importantly, if you’re a director of a limited company, then you will probably feature in this report as a Creditor. Look for a sub heading like:

Creditors: 1111111111 Your Name

It will be much nearer to the end of the ledgers’ report than the beginning. Generally, the Creditor ledger in your name shows how much you have taken out of your business. We try to keep the balance on that account as close to NIL as possible.

The report is presented from the company’s perspective. So if your Creditor balance is Black, you may owe the company money. The Company is “in the black” and that’s good from the point of view of the company. The problem is that it’s not good for you and (unless corrected with a dividend, then) you have an interest free loan from your company. HMRC does not like directors having interest free loans. When that happens they may charge you extra income tax on a benefit in kind.

If your Creditor balance is Red then that’s good for you (and not for the company) as the company owes you money.

Moreover, if our records do not wholly agree to your records, this 488120 report will help you establish any differences. Amendments to our records involve double entry bookkeeping, so if you want something changed you will need to tell us which two entries in the 488120 report are wrong and which two entries you were expecting to see. That could mean four bits of information for each amendment.

The 488160 report – an interim balance sheet – a snapshot of the business on that single day.

The balance sheet tells you where you stand with all of your various stakeholders, and it tells you what the business might be worth on the open market.

Fixed Assets – the value of the assets owned by the business (after allowing for depreciation). These items tend to be the major bits of plant and machinery. Normally, computers are not recorded here on the balance sheet, unless they are particularly hefty pieces of kit. Computers tend to appear under “equipment expensed” in the profit and loss account.

Other Debtors – For example a VAT refund, or SMP funding which HMRC sometimes pays to companies.

Customers – How much your customers owe you. If this figure is negative it will be in brackets and that means that your customers may have overpaid you.

Suppliers – How much you owe your suppliers. Negative figures (in brackets) mean that you owe them. Positive figures mean that they owe you.

Other Creditors – People you owe, like HMRC (for corporation tax) and the VAT office. This list of “Other Creditors” can include directors and employees who may be owed some money for expense claims. If any director has a positive figure by their name then they actually owe the business some money. Also, pay particular attention to the Corporation tax figures and due dates.

Total Funds – The Balance Sheet Value – the net worth of the company. If this is negative (if it’s in brackets) then technically you are insolvent. It is illegal to continue trading if you are insolvent. Talk to us because a short term deficit may be tolerated, but a persistent deficit needs remedial attention. If the Balance Sheet Value is positive, then this is the combined value of all the shares, and it’s the amount you (along with and all the other shareholders) might expect to receive if you sold the business on the open market. Don’t get too excited. If this figure is less than one million, it’s unlikely that anybody will be interested in buying you out!

The 488220 report – a list of aged debtors – customers who have not paid you

The oldest unpaid invoices are on the right. You should chase these customers and collect these overdue payments.

If there are entries in red under “unallocated creditors” then the records are showing that you have been paid by a customer, but either you have not invoiced that customer or there is a mismatch in invoicing and amounts received. Whether it’s an overpayment by them, or a missing invoice in your system, you need to correct the mismatch before the end of the following quarter.

Do not ignore aged debtors – they owe you money! If your records show that the old amounts have actually been paid before the end of the quarter date, then you need to let us know how and when the payment came in, because we didn’t see it arrive in your company!

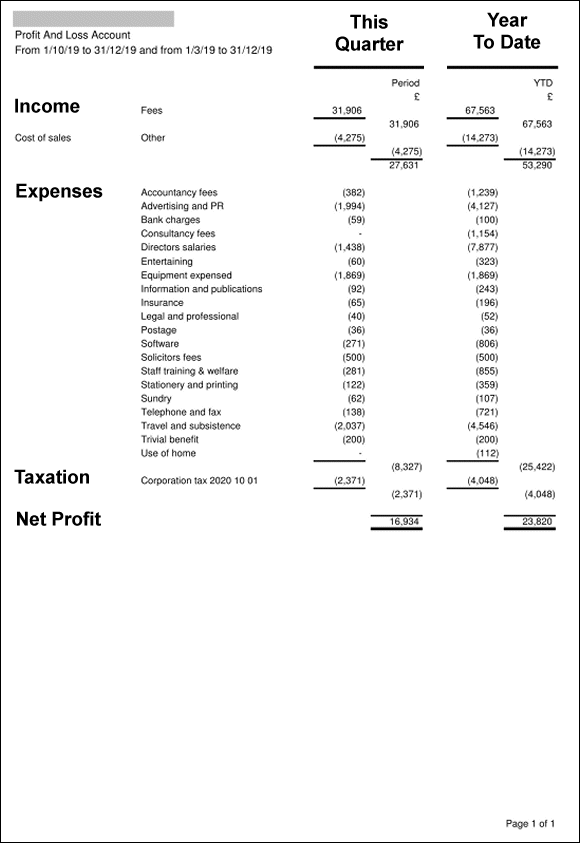

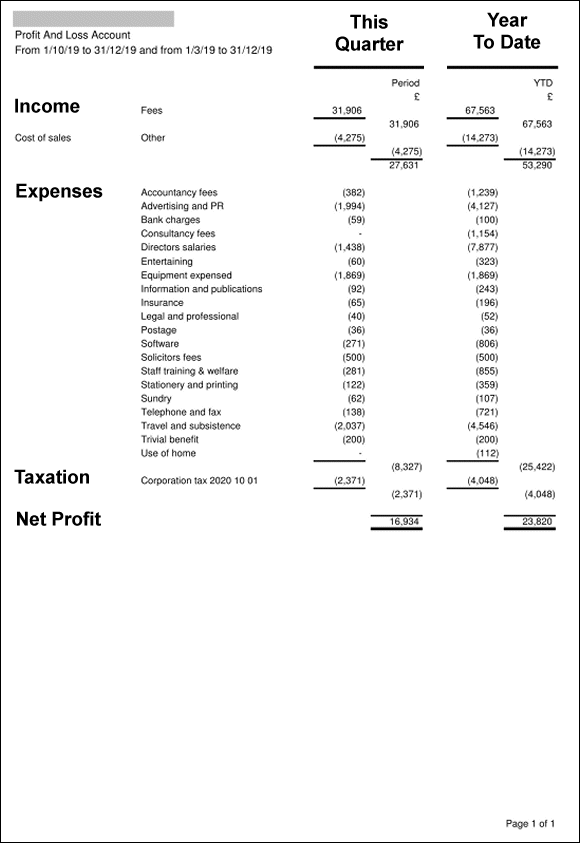

The 488240 report – an interim profit and loss account for the year so far

The first set of columns gives the figures for This Quarter. That is normally a three month period which fits in with the VAT quarters.

The second set of columns shows the whole trading Year To Date. That’s provided so that you can asses the activity in the current quarter and see if it is in character with all the data we have since day one of this trading year.

The Expense categories are the ones that we know about. It’s worth having a proper look at these in case something obvious is missing, or in case expenses are being categorised incorrectly.

A forecast of the Corporation Tax due. You should keep a tax reserve to one side so that you’re ready and have enough funds on the due date. Corporation tax does not appear on self employed accounts, because income tax for the self employed depends on many factors and not trading profit alone.

The bottom line – this is your Net Profit or loss.