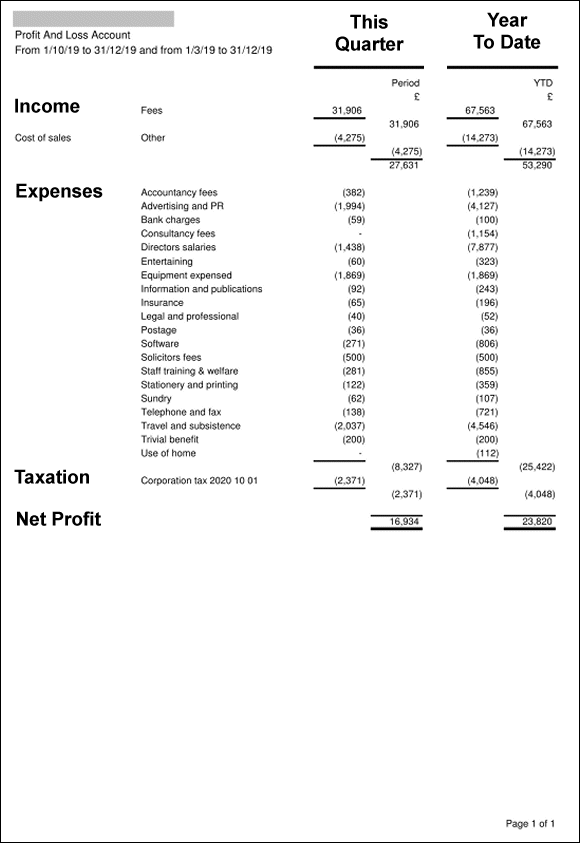

Allowable Expenses

The law is deliberately vague when it comes to defining what is an allowable expense for business purposes. Subject to some defined exceptions, we start with the principle that for a business expense to be allowable it has to be incurred “wholly and exclusively” in the course of the furtherance of the business.

That’s quite a tough test to start with, and you must ask yourself three questions.

1. Is that thing you’re thinking of wholly and exclusively for business purposes?

2. Will it further the commercial interests of the business? How?

3. Or will it further the personal interests of you the director?

We once had a client try to claim that her wedding on the island of Ibiza was an allowable expense of her UK limited company. And included in her records was the hefty bill which had been made out in the name of the groom! Anyway, she’s no longer a client, but it illustrates the point. We have a policy of deliberately losing some of our clients as per item 9.1 here.

Back to allowability – is your iTunes bill wholly and exclusively for business purposes? Please keep corporate matters corporate and personal matters personal.

The law is set out at s46(1) Corporation Tax Act 2009 and in short it says “do it in accordance with UK GAAP”.

And where is UK GAAP defined in law? It isn’t! So what does it mean?

To find out what it all means you’ll need to read a dozen or more lengthy volumes of rules, because the Generally Accepted Accounting Practice in the UK is a whole body of accounting standards published by the UK’s Financial Reporting Council. Deloittes have published a condensed version in one massive handy-to-read volume, and it will cost you only £600.

The easier way to do this is to trust your accountant, because our professional training, and the on the job training and the repeated exposure to the generally accepted accounting practices during our careers means that accountants have a good understanding of what is generally accepted. And, as a profession we are required to prepare a true and fair picture of where your business stands. So claiming food for the guard dog is fine, as long as the dog is wholly and exclusively for business purposes. Your charming Yorkshire Terrier doesn’t quite fit the bill!

Dual purpose

Basically anything that has duality of purpose (private and business) fails the wholly and exclusively test. By concession, HMRC will allow a number of variations to that rule, and they also flatly refuse anything which pushes the rule too far. HMRC will give you tax relief only for furthering the aims of your business and not for your normal obligation to house and feed yourself. That means that those boxes of Nespresso coffee capsules will be disallowed. It’s about having a level playing field where you benefit the way that other businesses benefit, but you do not get tax relief on things which ordinary taxpayers do not get tax relief on.

What is “a business” anyway?

In order to establish what is a business expense, it also helps to know “what is a business”? A business is “an activity which is earnestly pursued with the objective of making a profit” as set out in the case of Customs and Excise Commissioners v Lord Fisher 1981.

So it follows that a business expense is a cost which is incurred in order to increase the chances of that activity making that desired profit. If the reason for incurring an expense is not the furtherance of the business (more profit), then it is simply not a business expense.

General Exclusions

Entertainment! Directors and employees can claim back business entertainment expenses, but remember that your employer will not get tax relief on them! There is a specific exclusion for entertainment costs. No matter how much you spend on entertaining clients, prospects and yourself and your staff, it’s all going to be ignored for tax purposes. It can be legitimately reimbursed, but in tax law it’s not an allowable expense!

Employers take note . . . taken to extremes, this could mean that a business with £10,000 of sales and £10,000 of entertaining has NIL profit on paper. For tax purposes, the same business has £10,000 of sales and NIL allowable entertaining, and actually has a £10,000 taxable profit. At 20% that could lead to a £2,000 tax bill! And that’s for a business that has NIL in the bank, because they spent it all on entertaining!

Travel and subsistence is allowed when you have to travel away from your normal place of work and put in a long day in order to do that (or spend a night away, etc). Generally journeys of less than 40 miles and/or hours of less than 9 hours per day will not be sufficient to justify a “travel and subsistence” claim. Nor will buying your lunch in Pret every day! HMRC will give you tax relief only for furthering the aims of your business. Caillebotte v Quinn

Commuting in the sense of ordinary commuting between your home and your normal place of work is not allowable. This applies to users of all methods of transport, whether public transport, private car, bike etc Section 338 ITEPA 2003 . Travel to a temporary workplace is not ordinary commuting and so the cost is deductible, but there are special rules about what is and what is not “a temporary workplace”. Having said that, journeys which are substantially similar to “ordinary commuting” are also disallowed.

Clothing is not allowable, unless it is protective clothing, or it’s a uniform which carries a conspicuous advert, or (for Theatre Companies) you’re buying costumes. Mallalieu v Drummond

Laundry If clothing is not an allowable expense then it follows that laundry is not an allowable expense. However, if you’re one of those special cases (see the previous paragraph) then you can claim for cleaning clothes and you will need receipts to support your claim. Naturally if you’re a self employed painter decorator and you wash your clothes at home then you won’t have any laundry receipts but you can claim the HMRC allowance – an annual amount of £60. Mulheran v HMRC

Gifts to customers (or suppliers) are not allowable unless they carry a conspicuous logo or message which promotes your services. If that is the case then they must still be worth less than £50 each. That’s why you see a lot of branded pens and USB sticks being handed out as freebies. There are other rules too, gifts have to have a degree of “permanency” so that rules out flowers, and food and drink!

Parking Fines. Remember “if the purpose of incurring an expense is not to help the furtherance of the business (more profit), then it is simply not a business expense” and that’s why parking tickets, etc are not allowable. If you have some crazy sort of business where your profits go up and up directly as a result of getting more and more parking tickets, we’d love to know about it!

HMRC Concessions to the “dual purpose” rule

Use of home as office – if your costs go up, because you run a business from home, you can claim the excess. That’s a big “if” and it’s there to help people with the extra costs of electricity and gas etc. It is not there to help with the costs of rent or a mortgage. And that’s because your rent or your mortgage do not increase, just because you have a business. The same goes for council tax – it’s not business related and the Government is not in the habit of allowing subsidies for costs which you would incur anyway – whether you have a business or not. If your business is genuinely run from home, you could work out the extra element of the cost of your utilities on the basis of time apportionment and/or square metres and claim that. Alternatively, you can claim a fixed amount per week under the HMRC concession. That was £4 per week for periods to 5 Apr 2020 and is now £6 per week for later periods. We know from experience that doing the long winded formula or just using the HMRC figure tends to give a similar result, so it’s easier just to go for the HMRC concession. The only cases we have where professions dictate having a cost consuming “office” at home are for a Dentist and for a General Practitioner. If you’re in a profession where you need to dedicate part of your home to special facilities, we can examine the use of a more robust formula, though that’s a very rare exception.

Motoring – in very few cases does it make sense to have a company car. The tax costs are simply too high. In most cases, business owners may do some business trips in their own private car. HMRC will allow you to claim for the business element of your motoring. The strict apportionment rule means logging all of your motoring costs in full and logging every single journey (both private and business) in order to calculate the business percentage of those costs. The easier way to do it is to log only the business journeys and to claim the HMRC approved FPCS rate. See this report for more details.

Benefits in Kind

Staff salaries are a business expense. Benefits in kind (like private health insurance, gym membership, company cars, etc) are also a business expense, but are subject to special rules. Because benefits in kind are part of a remuneration package they are treated like salary and that means that the monetary value must be established. The business is then subject to employer’s national insurance on that figure (at approx 13%). Additionally, the employee is subject to income tax (as if the benefit was extra salary) and to employee’s national insurance (at approx 12%) on that figure. In the case of many smaller businesses, benefits in kind are not a cost effective way to reward the director/shareholder, unless you like the idea of paying approximately 25% extra in national insurance.

Is it fair?

The legal types amongst us will relish the thought of challenging HMRC in the tribunal system. The rest of us will simply follow the rules. If any of your staff take issue with that, ask them to take a look at the Senior Manager test.